With the conference season in full swing, it’s always eye-opening to revisit presentations we’ve shared around the world. Hardly a year goes by in digital marketing where you don’t look at something from a year ago and realize how much has changed. I’ll be bold here and say 2019 has been a landmark year for feeling the ground shift beneath our feet.

The results of the year’s transformations have yet to play out, but there are pulses underground right now that are likely to develop into changes that will feel like earthquakes when we look back on them in a few years.

Twin 800 lb Gorillas

Up until now (and still currently), paid media budgets are dominated by Google and Facebook. Putting money in them was like a slot machine where you were pretty assured a return, but that “sure bet” started to wear off as the platforms’ inventory plateaued and more advertisers rushed in. The good ol’ issue of supply and demand showed up.

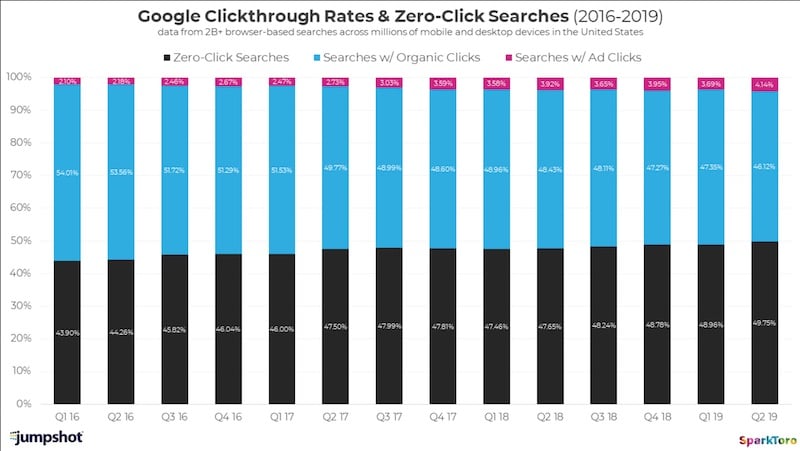

Paid search tends to be bottom-of-funnel, and manufacturing more of it is generally a market ebb and flow. The industry’s addiction to conversion rate made paid search THE place to put money for awhile, until brands discovered their results weren’t growing. Even the organic side of Google has faced backlash from brands, encapsulated in the recent clickstream data study by SparkToro (using JumpShot data) that showed less than half of Google searches now result in a click to a website:

Facebook entered the scene years after Google, but the low costs combined with surprisingly effective direct response results made it the initial place brands diversified that paid media to.

Then Facebook started suffering from what Google PPC did: higher costs, plateaued inventory, and a flood of users and ads. As with Google, conversion rates went down on a per-advertiser level.

Make no mistake, Google PPC still remains a strong ad channel. However, it’s mature enough now that many brands know what it is and is not good for: good for closing a sale, but not for brand awareness.

Facebook Ads? Well, they’re in an interesting spot in their evolution.

Facebook Ads on Shaky Ground

“But Susan, you’re a Facebook Ads person!” Yes and no. I’m a marketer, as is everyone at AIMCLEAR. We utilize the channels that perform, and Facebook Ads is still one of them, but not the way it used to be.

While the privacy to-do’s were the major news in mainstream media, there have been headaches for managers that continue to plague brands trying to effectively spend money. As of 2018, average organic reach of a page dropped to 6.4% of pages, compounding a 20% tumble in organic reach back in 2017, with some reports saying brands saw up to a 50% decline when Facebook refocused the Feed on updates from friends and family. This has increased the competition in the ads space as getting content seen consistently now requires an ad of some kind.

Reliability in the channel has also been a consistent gripe from advertisers, from a broken system during the important Thanksgiving selling week, to a $40m settlement this week about inflated video metrics, to generalized frustration with the ad reps.

Truly, the main issue for brands is they want to move the money–but to where? In the midst of all this angst over the platform itself, there’s another factor at play advertisers have to consider:

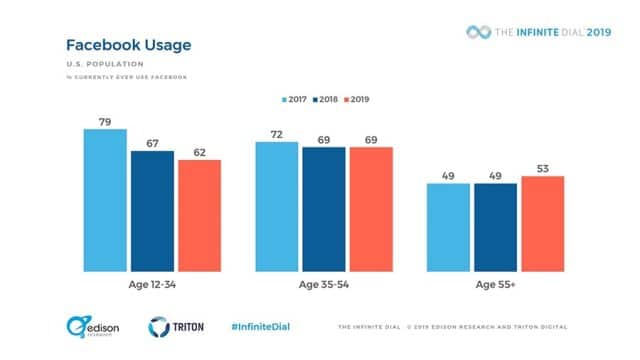

The demographics that exist on Facebook Ads have shifted. As Facebook ages, typical users are skewing older.

Growing Diversification in the Ad Space

An Edison research study showed the age group declining fastest on Facebook is the 12-34 age group, while 35-54 has remained flat the past two years, and their growth is in the 55+ area.

As the younger age group gets older and their buying power grows post-college, Facebook no longer seems to be the platform that will grow with them.

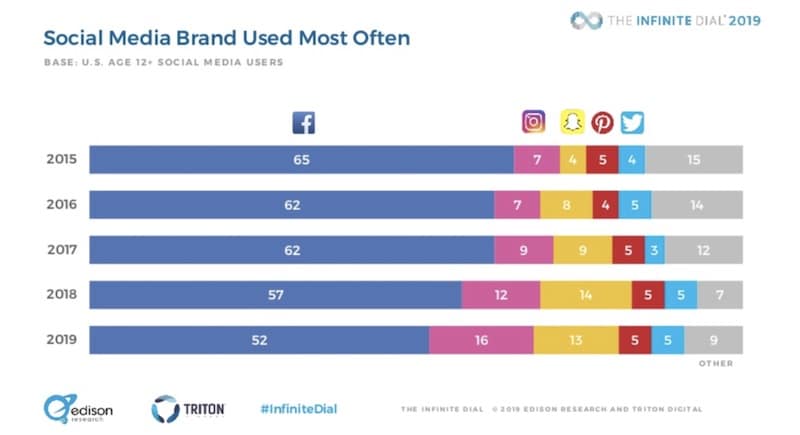

A look at where they’re going coincides with the ad growth we observe on these platforms:

As Instagram is still owned by Facebook, it might seem like more of the same. However, as we’ve highlighted, the mechanics and adoption rate of ads on Instagram are changing, making it emerge as a different platform from Facebook.

The growth of Snapchat is also notable, with stagnation in both Pinterest and Twitter.

The gray area is comprised of “others,” though there’s one in particular we have our eye on.

The Fast Growers in 2019

Instagram is the heavyweight here. Their growth is notable, going from 700m users in April 2018 to 1 billion users in June of this year.

It’s also hard to ignore the growth that happened from 2017 to 2018 with Snapchat. Worldwide, Snapchat users totaled 203m in Q1 of this year, up from 190m the same quarter in 2018. There are 10 billion daily average video views on Snapchat, and as of Q2 this year, a whopping 3.5 billion snaps were sent daily.

What do all those stats mean? Ad inventory growth!

When you combine Snapchat’s growth with a 92% penetration rate amongst 18-24 year olds, you start to see where younger demos are moving, and how their preferred social experience differs. (Similar to what we see with options like Instagram Stories.)

The notable channel not listed here that’s on our radar is TikTok. It’s the #1 most-downloaded app in the Apple store currently, with 500m active users worldwide. 60% of the app’s monthly active users are 16-24 year olds–again, easy to see where younger users are flocking.

“For Your Consideration…” Platform Enhancements to Woo Ad Dollars

Other platforms trying to court budgets previously earmarked for Facebook have not sat idly by. Sites like Pinterest have made their ad formats more robust with additions like “Shop the Look,” and added video-specific features including an improved uploader and a video tab on business profiles.

Instagram, despite being Facebook-owned, has led the way in adoption of new features that drive success for advertisers. Additions such as Shopping Posts and the ability to include polls in Story Ads are banking on the fact younger users want a more engaging experience beyond a static image in a news feed.

Given All This, What Have We Learned in 2019?

The growth we are seeing is of interest for more reasons than simply being outside of Facebook. It’s notable because the ad experiences on these other platforms are vastly different. While Instagram still features a feed as its main experience in the app, the growth in Instagram Stories is paving the way for the channel’s future. The growth of Snapchat and TikTok highlight the preference of users for deeply immersive social experiences.

What does this mean for ads? It is clearly time to adapt NOW. While we can always drive results through static ads to an extent, future inventory and favorable cost will go to daring brands that evolve ahead of the pack in the new areas.

It also means brands must re-focus on building brand awareness and stop trying to sell so hard to every user they encounter right away. The decline in direct response sales within Google and Facebook are a warning shot that message-overload has settled in. Combine that with advertisers duking it out for primo inventory, and the way ad dollars are valued and evaluated must evolve.

Pushing bottom-of-funnel sales isn’t sustainable when you don’t fill it from the top. The stagnation (and sometimes regression) we’ve seen in Facebook Ads and Google will continue to be a problem for brands that refuse to experiment and embrace the new frontiers in paid social. To the victor go the spoils, and 2019 is sending strong signals about who will win in the coming years – pay attention, start your engines, and explore these emerging frontiers with us.