It’s a bit like eating an elephant, a labor-intensive conundrum of today’s online marketing ecosystem. The more keyword, contextual and competitive data available to mine, the more effort is required to properly research a product’s proper place. The investment is completely worth it.

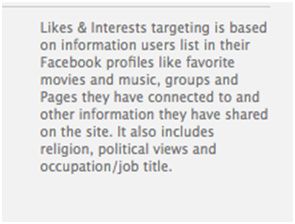

Regardless of channels we plan campaigns in (flavors of SEO, PPC, Social Media, etc…), the objective of demographic research is to attain a data-driven and comprehensive familiarity with products and categories. From there, we strive to accomplish channel-coverage where relevant. This article offers several semanticstarting points for the process of mapping traditional “search” inventory thinking to Facebook PPC segments.

We begin with classic “search” keyword research. Next, it’s all about mapping semantic inventory to any salient data available to advise marketing efforts. Here are a few ideas for generating demographic insights from social media, stemming from and moving beyond keywords.

Brand Terms & Your Competitors’ Brand Terms

These days there’s no shortage of inspiring SERPs that shed light on competitors’ brand and product terms. Of course, we would know this already from traditional l keyword research, competitive PPC intelligence and other sources. Still, a quick trip to the Google SERPs gives us all the data we need to start mapping traditional search to Facebook.

Lately, Google has been inserting big brand SERPs suggestions in various locations. There’s a bit of a to-do about it, since obviously this is to the detriment of smaller brands. Well, thanks Google for making my job easier with the suggestion of big competitors! We like to start here.

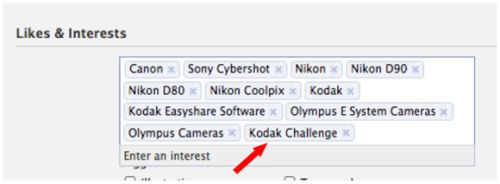

But really, despite one’s competitive research starting point, it’s easy to map brands and products to Facebook. In each of the FB screen captures from here on out, we’ve selected a few examples of many possibilities.

It’s fun to note that in the competitors’ brand bin, we’re picking the pockets of the Kodak Challenge… bummer for Kodak 🙂 .

Product Categories

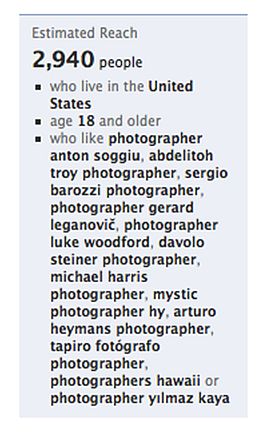

Categories are easy, too. Ask yourself the question: “What are the main lines of activity surrounding digital camera usage?” At this stage of the game, we’re only limited by our creativity. Here are a few to think about. (Please note that the “photographer” interest could apply to professionals or amateurs. We’ve left it in the B2C bucket for now.)

Professionals & Consumers Who Use The Product & Services You’re Marketing (Using the Interest Tool)

Facebook is awesome for mapping keywords to social (contextual) inventory. Zero in on customers, both B2B and B2C. This can take some guile and imagination. Let me take you through some examples. (Remember, we left “photographer,” a huge segment, on the category side of things– so it’s not in this bucket.)

Relevant Firms (Using the Interest Tool)

Clearly there is B2B booty-loot to be spooged from Facebook. I’ve grabbed a few firms of many who might be interested in digital camera gear. Please note that these are FB users “interested in” activities like “Michael Harris Photographer,” which is a bit different than stating straight-up that they “work for” Michael Harris Photographer. This seemingly subtle differentiation is worthy of a tutorial in and of itself.

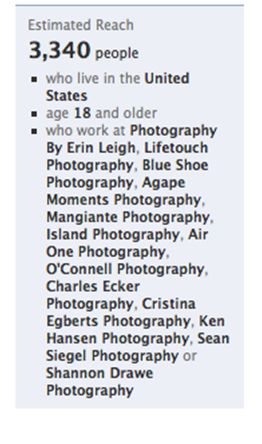

Professionals & Consumers Who Use The Product & Services You’re Marketing (Using the Education & Work Tool)

Here’s the same type of research from the “where I work” bucket.”

Think Hard About Occupations

Regardless whether users disclose that they are fans of or work for specific companies, or from the education and work segment, this data is valuable insight for marketers. Say you sell scientific software, regarding water with an environmental slant. Again, discovering the occupations of professionals who consume your products is only limited by your research time and guile.

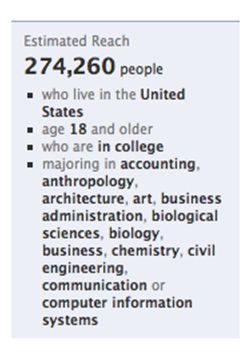

College Majors

I once had a client that built airplanes. The old joke was, “Gee– I guess we need to manufacture a few pilots!” Think about the long-term ramifications of brand building, holistic benevolence and direct response sales to those studying to be come professionals in any category. We pulled these 250K+ students studying specific major from FB. There’s a lot of short tail inventory there in wacky Facebook corners to mine.

The job of mapping brands to Facebook PPC can be a great big furry animal to eat, but the more data we have regarding social PPC segments, the more comprehensive coverage we can attain for a client. Just remember… one bite at a time, people.

In review, here are a few starting places for your marketing pleasure:

- Brand Terms & Your Competitors’ Brand Terms

- Product Categories

- Professionals & Consumers Who Use The Product & Services You’re Marketing

- Relevant Firms (Using the Interest Tool)

- Professionals & Consumers Who Use The Product & Services You’re Marketing (From the Education & Work Tool)

- College Majors