When it comes to marketing via top-of-funnel channels like paid social and programmatic display, many marketers are still fixated on the immediate value of conversion. While getting the conversion is critical, today’s smart marketer also looks to these channels to boost the brand long-term.

Think about it: Each interaction with a prospect, every eyeball, every click creates a brief touchpoint for the brand as a whole. So does it make sense to do some brand-specific pushes in social, even if they don’t drive the ever-important conversion right away?

Best way to find out is to test the concept!

Think about those old school TV ads. Did every commercial about trucks drive every prospect to buy a new pickup? Not even close. But, the touch point mattered in building the brand long-term.

Paid social, specifically, can be an even more powerful channel to boost the brand. Let’s construct a brand lift test to see how it can be done.

We’ll look at common tools and methods, along with essential foundational aspects of marketing in social channels to help establish a brand-boosting program for your business.

Educate & Set Expectations

First, if this type of study has not been undertaken before in the organization, it is important to educate and set clear expectations with stakeholders beyond the objective and nature of the test. Isolate the primary KPIs specific to proving or disproving the hypothesis and keep all involved focused on these metrics.

Don’t get distracted with peripheral theories or measurements not pertinent to the the test. Strong education upfront is key, here. This test should represent the first in a series, each building on the last.

Create the Framework

This will also assist in keeping stakeholders up to speed on how the test will be organized, and the order of operations over the term of the test. Here is a phased approach we’ve used to prioritize measurement specific initiatives within a lift analysis:

Phase 1: Pre-Launch

- Analyze traffic trends in test markets

- Estimate in-market population

- Analyze market penetration by test market

- Select test markets

- Calculate expected traffic & conversions for test markets

Phase 2: Active Campaigns

- Integrate ad data with traffic data

- Automate correlation analysis

Phase 3: Post-Campaigns

- 4-6 week post analysis: Decay, latency, incrementality

- Finalize correlation

- Attribute incremental traffic & conversions to campaign

- Back in to performance benchmarks

- Scale to broader marketing program

Track Brand Search Demand

There are a few different ways to approach brand lift measurement. Keep in mind brand lift should be more than just tracking Organic search; direct traffic should also be measured. In all methods, this data should be analyzed in three phrases: before launch to establish a baseline, during the test to capture any deviation from the forecast, and after following the pilot to understand any branding latency and decay effects.

You are likely familiar with the survey-based brand lift products offered by Facebook and Google. The methods below are complementary to these products. Each have their own advantages and disadvantages.

Let’s have a look at a few methods for measuring brand lift in your top-of-funnel campaigns.

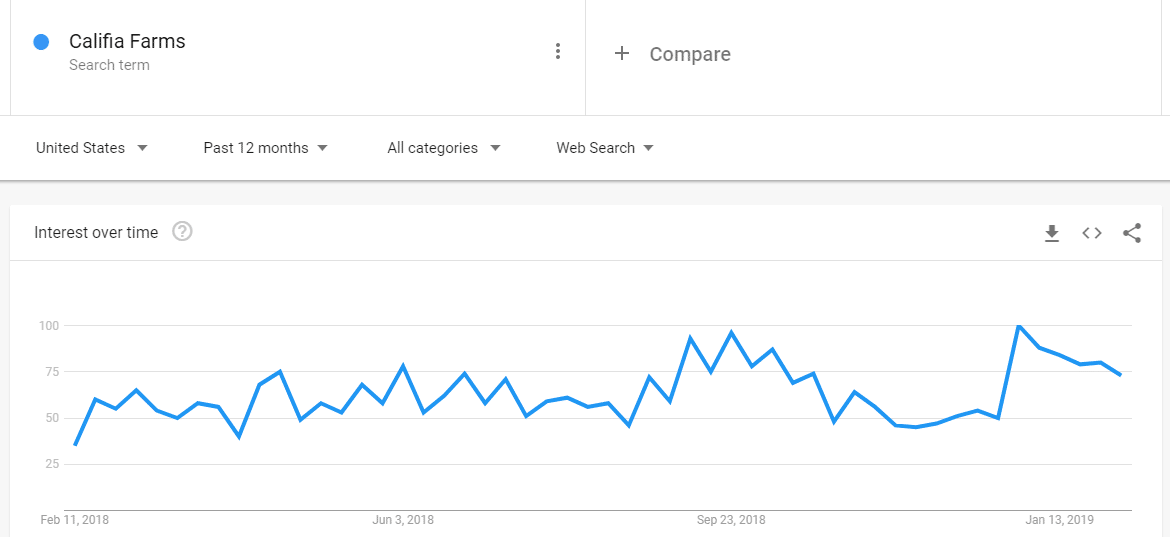

Google Trends

-

- Pro: Search interest data can be segmented down to DMA.

- Con: Google Trends does not provide search volume, but rather the search intensity for a period in time normalized by the peak interest in the time series.

- Con: Trends data is adjusted to remove duplicate searches from the same individual.

Overall: This data may not provide a statistically defensible conclusion, but could provide directional indication of brand search trends.

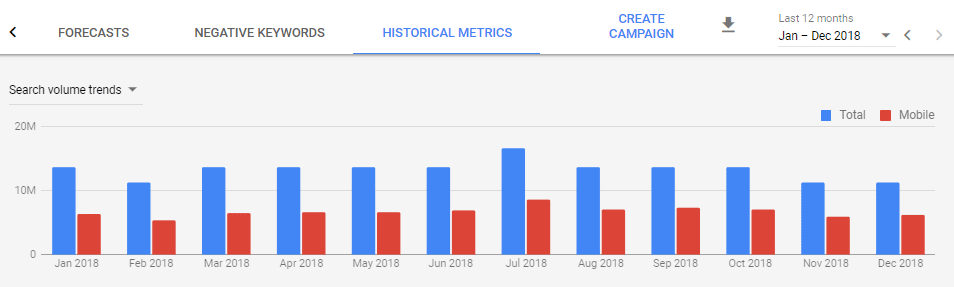

Keyword Planner & Forecast

-

- Pro: Ability to evaluate historical search volume and forecasts through the next quarter.

- Con: Highly directional. Search rates are sampled over time and averaged across the lot. The swing of actual search volume vs estimated can vary significantly based on the formula.

- Con: Search volume is grouped into averaged tiers, which vary widely and eliminate the ability to measure lift within the margin of those tiers.

- Overall: Not a dependable data source to measure effectiveness of brand search lift.

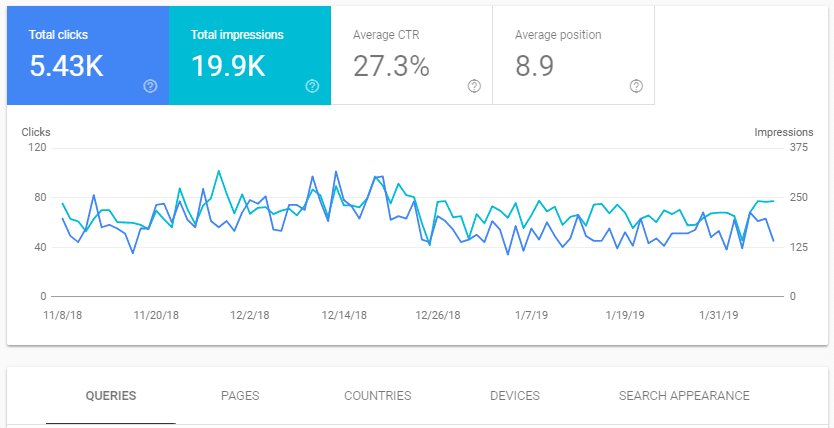

Search Console

-

- Pro: Absolute values for the number of time your domain appeared in the SERP for the brand term, excluding Google Ads impressions. Assuming you rank 100% of the time for your brand, this should give a highly accurate brand search volume figure.

- Con: Data can only be filtered down to the country, not allowing the ability to evaluate brand search at a DMA or sub-region level.

- Con: Search Console data is not compatible with GA segments, eliminating the ability to break out brand query volume data by geo.

Overall: Does not provide the ability to parse the data in a usable way for the purposes of measuring brand search lift in market areas.

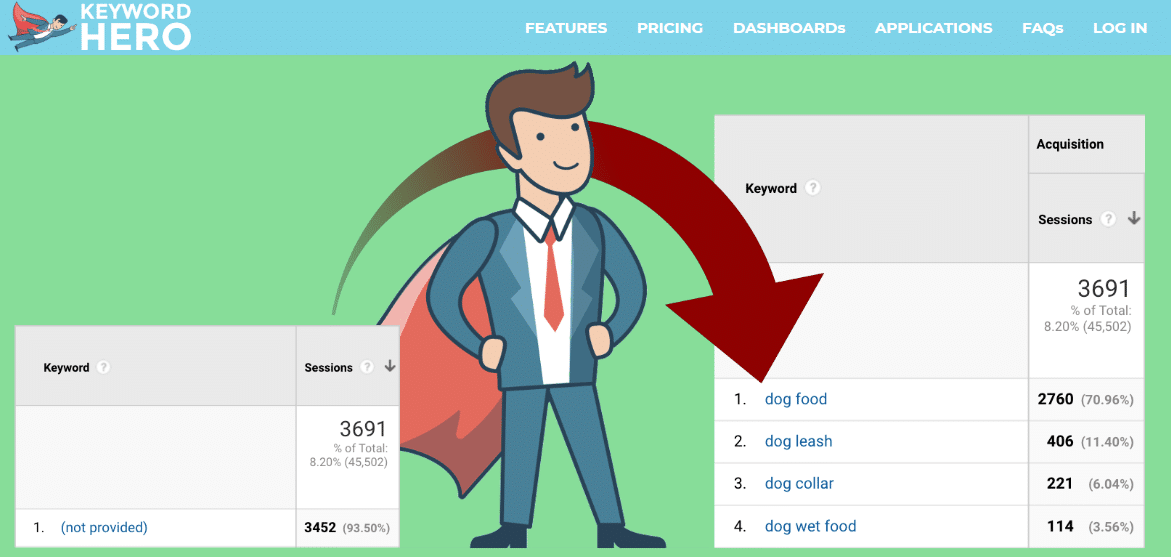

Keyword Hero

-

- Pro: Recaptures most data from organic search terms labeled as (not provided) and maps users’ organic search terms to their sessions in Google Analytics.

- Con: Additional cost and provides another 3rd party blackbox access to your data.

- Con: Cannot assess data retroactively.

- Overall: Getting closer.

Paid Search

-

- Pro: Provides the ability to capture impression volume.

- Con: Campaigns must contain the specific geo as a target object within the campaign or separated into its own campaign in order to evaluate impression share data.

- Con: During the test period, it is important that no changes be made to the test campaign & control regions that would increase ad exposure to new search inventory (i.e., turning on/off search partners, add/removing keywords)

- Overall: Preferred method for tracking brand search trends.

These tests can be difficult to setup and carry out, depending on the technical environment as well as the performance of the business as a whole. Make sure to understand the influences that may impact your test and account for those in the forecast model.

Businesses need marketers who can cut through noise and identify ways to spend the next dollar more wisely. In a last-click world, tests like the brand lift analysis provide a better understanding of the downstream impact of your top-of-funnel ad dollars, and help answer some of the business’s more challenging questions.

This more holistic view brings greater clarity into the value of brand and a marketer’s ability to think longer-term, rather than focusing on the campaign of the moment.

Start small. Create some tests based on the ideas above and then invest a little more time in how you view your own role as a brand-building, conversion-driving marketing machine.

Happy testing!