TL:DR – Yes; (Google Sucks) AND… consumer fear, inflation fatigue, job insecurity, and a sluggish economy are killing search demand before anyone even types a query.

Organic search traffic has been falling off the back of the algorithmic truck for 20 years. That’s not news. Stakeholders panicking about it? Also not news. What is news? There’s no single cause, there are multiple converging factors at play and we’re now in a perfect storm of search disruption, AI absorption, economic constipation, and Google doing everything short of launching a pop-up shop in the SERPs to keep users from ever clicking your damn link. You shouldn’t be talking about traffic and should have only been talking about conversions.

So this piece isn’t just a finger-pointing tirade (though, yes, G, we see you). It’s a hard, fact-packed reality check for marketing pros trying to explain what happened to their traffic and why we might all need to stop pretending it’s 2013.

Buckle up. Bring snacks.

AI Overviews (AIO): Google Does the Search, You Get the Shaft

At Google Marketing Live 2025, the search overlords went full throttle on the AI agenda. Ads in AI Overviews are expanding globally, and AI Mode (the fully conversational Google experience) is now getting integrated ad placements. This means the zero-click experience isn’t just a UX experiment, it’s a revenue machine for Google, and another obstacle for brands and SEOs trying to win organic clicks. According to Google, these AI-powered experiences drive “higher user engagement and satisfaction.” But for marketers, it’s more like higher blood pressure and content invisibility.

Google also introduced Power Pack, a next-gen set of AI ad tools designed to supercharge performance across Search and YouTube using Performance Max, AI Max for Search campaigns, and Demand Gen. One click and AI expands your keywords, writes your creative, and claims your lunch money. And Performance Max now offers more transparency, like seeing which channels your budget’s disappearing into. Congrats?

In Q1 2025, Google reported that AI Overviews were being used by over 1.5 billion people each month. That’s roughly 1 in 4 internet users globally, or close to a fifth of the entire human population. Massive, but not exactly shocking when you realize AIOs now appear in more than 54% of all Google searches, according to Ahrefs. It’s not a side feature anymore. It is the interface.

Let’s be real. Google is snatching your organic traffic like it owes them rent. AI Overviews rolled out in full force by the end of 2024, with Google proudly claiming users “love it” because it does all the work for them. That work used to be yours. Now? Google does the heavy lifting and leaves brands with crumbs.

Sure, they say users are “clicking a greater diversity of links.” But Mail Online’s director of SEO and editorial e-commerce, Carly Steven blew that rosy picture to hell, noting a 56% drop in desktop CTR and a 44% drop even when their link was in the overview (Press Gazette, May 2025). That isn’t diversity. That’s starvation.

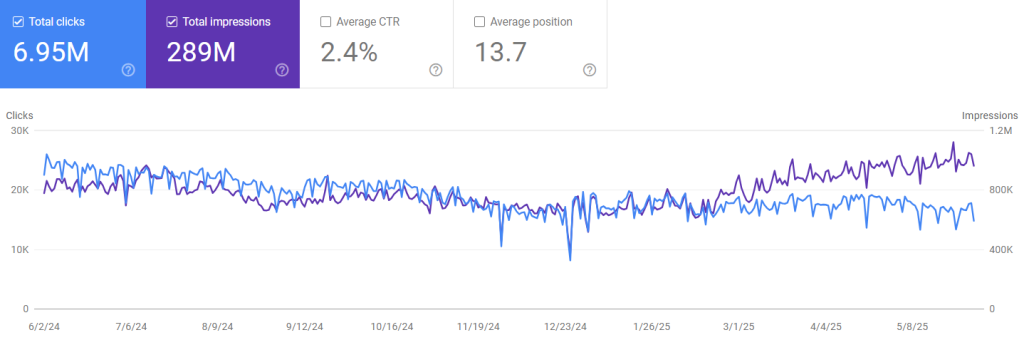

Many in the industry are calling it, The Great Decoupling Of Google Search. Meaning impression increases no longer equals click increases as you can see in the image out of Search Console.

LLMs: ChatGPT and Perplexity Are Stealing Your Lunch

OpenAI’s ChatGPT has become the cool older sibling that users now trust more than Google. By Jan 2025, 14.7% of internet users were using ChatGPT, double from the year before (Datos.live) and 9% of 45-64 year olds are using ChatGPT as a Google replacement (Business Insider).

So how fast is ChatGPT growing? According to AI Overviews, in May 2025, ChatGPT has around 122.58 million daily users. There are over 12 million paying subscribers to ChatGPT Plus at $20/month and the enterprise user base has grown to 1.5 million customers across Enterprise, Team, and Edu offerings, with adoption by 92% of Fortune 500 companies. ChatGPT is on track to generate $11 billion in revenue by the end of 2025.

Meanwhile, Perplexity quietly exploded in 2024–2025 with 15M+ Monthly Average Users and a 523% spike in usage (DemandSage, Datos.live) and they will end the year with $9 billion in revenue. These tools don’t just cannibalize traffic, they digest it whole. ChatGPT answers your question without sending you anywhere. That means your beautiful, keyword-optimized, content-rich page? Pretty much dead on arrival.

Gen Z is on TikTok, Not Google

This isn’t just a tech problem. It’s cultural. Around 40% of Gen Z prefer TikTok/Instagram over Google for search (Business Insider). Yes, TikTok. That lip-syncing, trending-sounding, short-form hellscape is where your next customer is searching for “affordable lawyers” or “local HVAC repair.”

And when they want to buy? 56% of U.S. consumers start on Amazon; just 42% start with Google (eMarketer, Feb 2024). Your product page isn’t even in the conversation.

It’s not just GenZ

Stop with the “my customers aren’t on TikTok.” It’s BS and you know it. Every Gen is on TikyToky. In fact, 30% of GenX is on TikTok and that figure is growing. From parenting to BookTok, social causes to the GenX Royal Caribbean cruise (leaving port November 9th, 2025); GenX is closing in on the 49% of our Millennials that are searching and shopping new cat and dog toys, music and concerts, games, influencers, trends, sports, products, finding the best tacos in any city across the nation or recreating recipes, trends and hashtags all on TikTok.

The Economy is in the Group Chat Too

While digital search habits are evolving, the real-world mood is darker still. Inflation, word of layoffs, and general uncertainty have created a vibe where people aren’t just burned out online, they’re anxious, defensive, and clutching their wallets in the offline world too. That fear bleeds into what gets searched, clicked, and ultimately bought, or not.

Consumer Confidence is Shaky AF

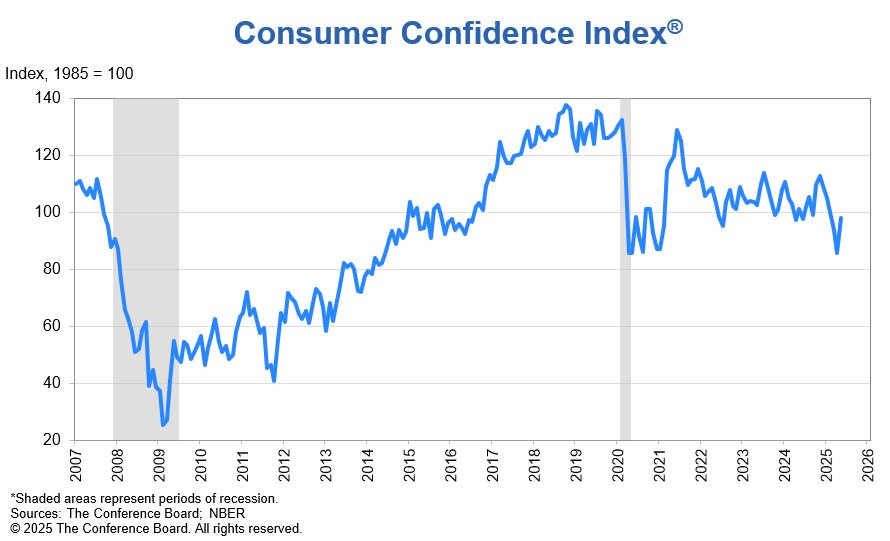

Let’s talk about the recent Consumer Confidence meeting the anxiety-driven lows of the pandemic. The U.S. Consumer Confidence Index (CCI), as reported by The Conference Board, is benchmarked to 100, which represents confidence levels in 1985, the “neutral” year economists chose as a baseline.

How to interpret it:

- Above 100 – Consumers are feeling good. They’re confident about the economy and spending more.

- Around 100 – Cautiously optimistic. Neutral to slightly upbeat.

- Below 100 – Consumers are feeling pessimistic. They’re more likely to save money, delay purchases, and cut back, bad news for marketers.

Key thresholds:

- 90–99 – Mild concern. Consumers may still spend, but they’re thinking twice.

- 80–89 – Anxiety. Spending slows noticeably.

- Below 80 – Danger zone. Consumer confidence is recession territory. People are scared, hoarding coupons, and definitely not impulse-buying anything with a $299 price tag.

Consumer confidence fell from 93.9 last quarter to 86.0 in April 2025, with expectations at a recession-level 54.4 (Conference Board via think.ing.com).

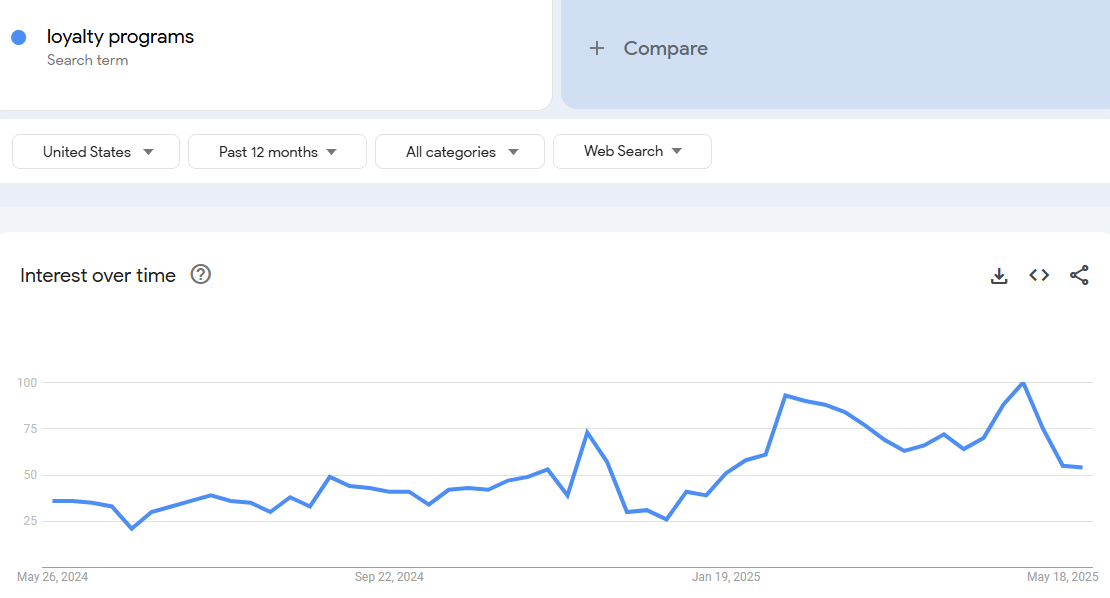

Inflation’s still biting. Google Trends shows a value-shift: searches for “buy 1 get 1 free” and “loyalty programs” surged.

Meanwhile, “luxury brand” and “refinance mortgage” have tanked. It’s Maslow’s hierarchy of search intent now.

Freight Recession, Tariff Talk, Inflation, and Supply Chain Sadness

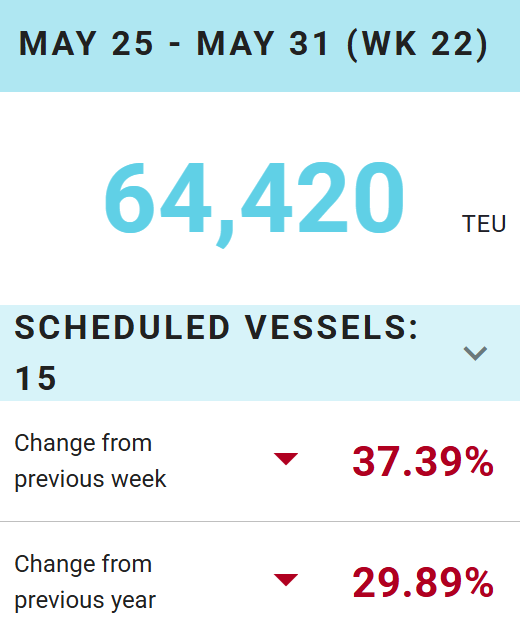

Freight is a critical indicator. Many stats show trucking demand is down big-time. Ports are quiet.

Meanwhile, U.S. trade policy continues to inject uncertainty. Tariff discussions and unpredictable enforcement have rattled supply chains and the businesses relying on them (Reuters). Importers hesitate. Exporters delay. Consumers get hit with higher prices or out-of-stock notices.

And let’s talk about inflation. Though it peaked at 9.1% in June 2022, inflation remained sticky, hovering between 3.5%–4.5% through 2024 (BLS), with core categories like housing, groceries, and gas keeping wallets tight. The Federal Reserve’s rate hikes added more pressure, cooling borrowing but also consumer enthusiasm. By 2025, the inflation fatigue had calcified: even if prices weren’t rising as fast, they were still high, and people were tired of it.

This mix of freight disruptions, tariff anxiety, and inflation fatigue creates a triple threat. If people aren’t buying because they’re broke, cautious, or the thing won’t arrive anyway? They stop searching. Revenue follows.

Job Insecurity: When No One’s Looking, No One’s Clicking

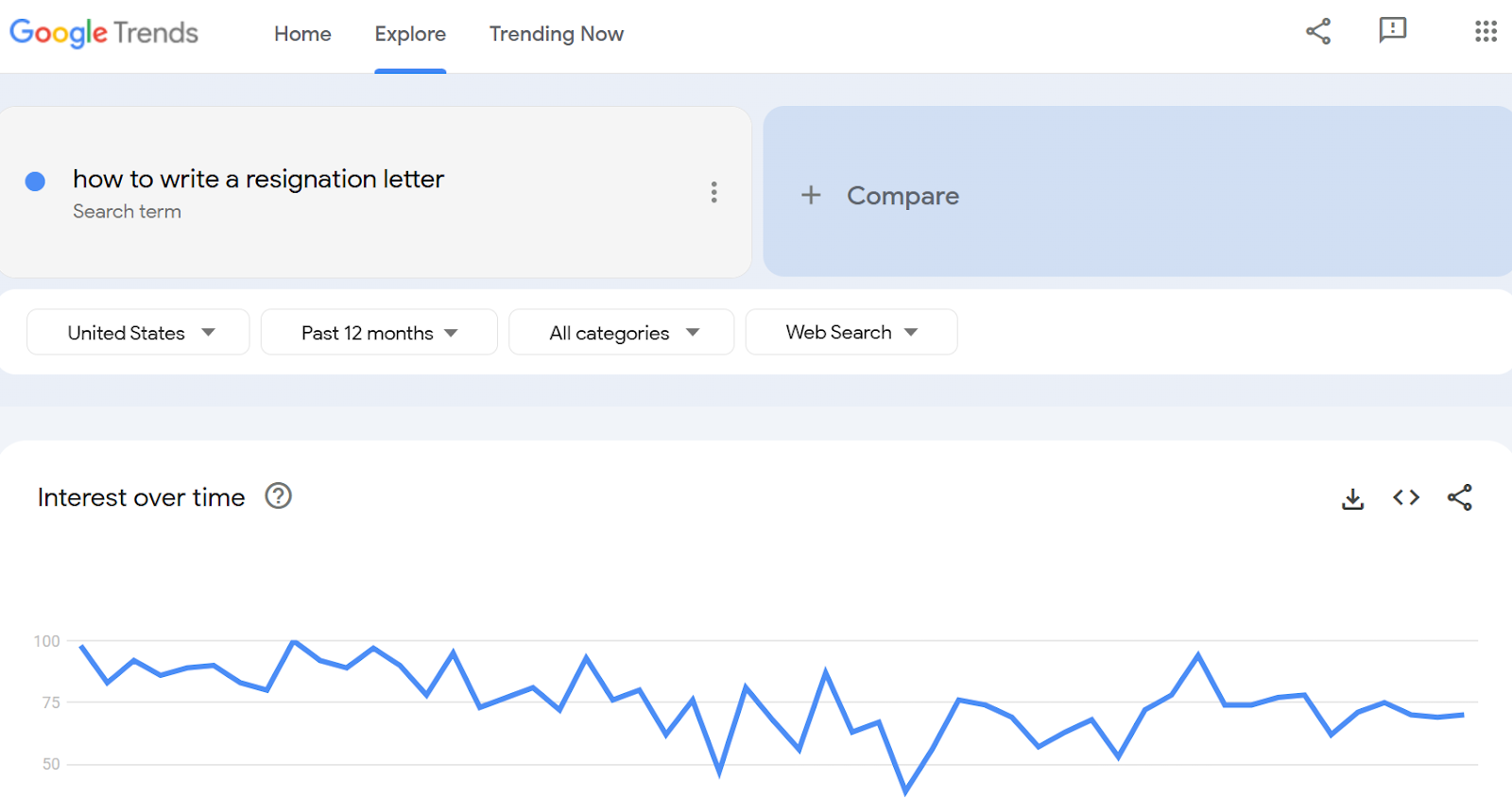

The labor market is spooked. Job openings dropped from over 10M in 2022 to just 7.2M in March 2025 (Reuters). That means less job-hopping, less application activity, and fewer searches like “how to write a resignation letter.”

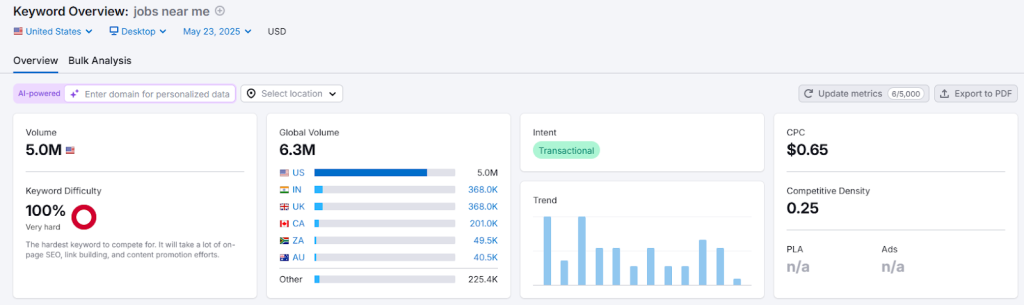

Less job hopping means fewer searches for “jobs near me” as seen in the drop on that Trends bar graph, May is stalled.

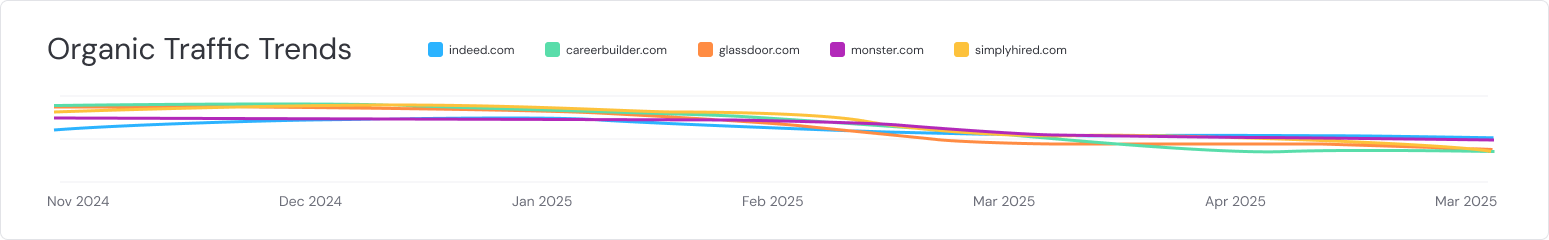

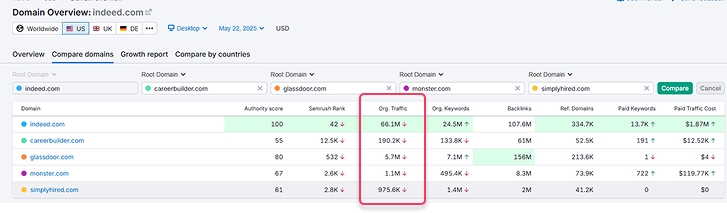

We see the receipts in keyword data on career sites like Indeed, LinkedIn, CareerBuider, etc:

- CareerBuilder lost -79% of its organic keyword footprint.

- SimplyHired: -58%

- Monster: -56%.

- Glassdoor: -44%.

- LinkedIn: -42%.

- Indeed: -25%

It’s eerie that each hiring brand’s Organic traffic has the same slide in retrospect to their size when reviewing in Semrush (pronounced “sem-rush,” bet).

This is what it looks like when your consumers’ confidence dips, your traffic dies in the economic gutter. People are not taking risks. They’d rather be the underpaid, longtime employees with ties than the new guy when the country is facing tough times.

So Yeah: “Yes, Google sucks; AND…”

Here’s the blunt version:

- Google is eating your traffic.

- ChatGPT is hoarding your questions.

- TikTok is now a search engine.

- People are scared to risk and spend.

- The economy still sucks.

You’re not crazy. You’re not failing. The world shifted. Your strategy needs to. Stop explaining traffic drops like they’re a fluke. They’re structural. It’s not coming back.

SEO is no longer just about Google. It’s about visibility, presence, and finding your audience

wherever they went after they ghosted your landing page.

Where Should You Start?

Off-site; retrain; and get seen.

Off-Site SEO Tactics

- Diversify where you build visibility. Publish thought leadership on platforms like LinkedIn, Substack, and Reddit where discovery is growing. Take it to video and TikTok, Reels, and Shorts… everywhere. They have search bars too, and they rank.

- Get featured and linked in LLM-indexable sources. Tools like ChatGPT, Perplexity, Claude, and Gemini prioritize reputable citations. Think Wikipedia, news coverage, and deep authoritative listicles, not just your own blog. Get other brands to talk about your brand

LLM Strategy Moves

- Claim your corner. Create “about us,” “FAQ,” and long-form content that establishes expertise, then test what ChatGPT, Gemini, Perplexity, etc say about you. If it’s off? Train it by building links from the sources it trusts: news sites, Wikipedia, forums, review sites, etc.

- Feed the machine. Contribute, contribute, and then contribute some more to the open web in ways LLMs crawl: answer on Quora, share on Reddit, publish GitHub repos or datasets, contribute to StackExchange, these often get pulled directly into LLM outputs.

- Answer questions as a friend. Be that trusted and nonbias. (I promise you can do it) Do not link to your brand or act in a promotional way; your job is to be the friend your audience comes to for advice, not a promo code.

What to Say to Stakeholders

- Educate with context, not panic. Show them this isn’t just a site issue, it’s a systemic shift in how people search and spend. Use concrete visuals (like the consumer confidence scale) to anchor the discussion in facts.

- Refocus KPIs on impact, not impressions. Traffic is down, yes, who cares! If you’re still talking about traffic this is a problem. We tell brands before they start with us we aren’t going to use traffic as a KPI that we need real human interactions to measure. So let’s talk about: how’s your revenue per visit? Lead quality? Direct or dark social engagement? Realign expectations toward what still converts. Focus on and talk about your audience and where they are.

- Lead the narrative. If you’re not explaining the drop, someone else will, and they’ll probably be wrong. Frame the story with confidence and clarity: this is evolution, not failure.

If you’re not on the first page of AI search, it might be because you’re not even in its vocabulary yet. Time to fix that. Get cracking on the list above. Yeah, it takes time. SEO was never free; it has always been hours of love and self-loathing. Get started now to see benefits months down the road.

If you need help with that? You know where to find me.

XOXO,

Lea